Grant of Millennial Money found himself unemployed, living at home with his parents, and with a bank account balance of $2.26 after graduating from the University of Chicago.

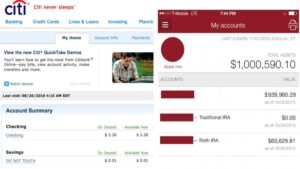

“That was a major wake-up call for me,” says the now 31-year-old, who only goes by his first name. “‘I never want to feel like this again in my life,’ I recall thinking. As inspiration, I took a screenshot of my bank account and set a personal goal of $1 million in assets in five years.”

He obtained a $50,000-a-year position in digital marketing, but he was unhappy. “This was rapidly realized to be insufficient funds. I wasn’t going to be able to make ends meet while saving 5 to 10% of my income.”

Grant came up with the idea of starting a side business building websites. “The first website I designed was for a law company for $300,” he tells CNBC. “That law firm ended up suggesting me to another law firm, and I went from charging $300 per engagement to $5,000 in six months.”

Within a year, he had sold his first job for $100,000. He then quit his full-time job to focus on growing his consulting business. Grant reached seven figures five years after taking a screenshot of his $2.26 balance.

In a post on his blog, Grant, who now lives in Chicago with his wife, outlines the five steps he took that helped him turn $2.26 into $1 million.

“I can’t guarantee that you will have the same results, but if you follow even just a few of these steps, you are likely going to be much better off financially than you are today,” he writes.

1. Get paid what you’re worth:

“The number one thing that will dictate your future earning potential and get you to $1 million the fastest is how much money you are being paid today,” Grant writes. “Unfortunately, you probably aren’t being paid what you are worth.”

The simplest way to boost your earning potential is to ask for a raise. Grant recommends looking at the salary range for someone with your level of experience in your industry, which will help you understand what you’re worth.

Then take that information to your boss and emphasize what you bring to the company. Remember, “it doesn’t hurt to ask,” he tells CNBC. “A lot of people are ultimately afraid that people are going to say no, and so they undervalue themselves and they undervalue their services.”

2. Save a ton of money… and put it to work:

“In order to build wealth, you need to be making as much money as possible on your money,” Grant writes. “Because you can only make so much money at any career, investing is truly the key to wealth.”

During his five-year journey to seven figures, Grant saved 50% of his income. Today, despite his financial success, he still focuses on living simply and sets aside 40% to 50% of his income.

The key, Grant says, is to make things automatic: “Talk to your HR company and have them start depositing at least 20% of your income directly into an investment account before you even see it. This is 20% of your earnings AFTER you have made 401(k) contributions.I have mine automatically deposited directly into my Vanguard investment account, and the money then gets automatically invested in a mixture of index funds.”

3. Develop multiple streams of income: —

After you’ve maximized your earning potential and are saving a good chunk of your salary, focus on increasing your revenue streams, whether by finding a part-time job, starting a side hustle, or establishing passive income.

“If building wealth is your goal, you must master the side hustle and make money in ways other than your full-time job,” Grant writes. “This can really be anything, including driving for Uber, consulting, or building websites on the side.”

“Once you find a great side gig, you will be tempted to spend that money in your everyday life as your bank account grows, but I strongly recommend you think of your side hustle as a key to building wealth (over the long term) instead of just being rich today,” Grant says.

4. Invest in what you know.

While Grant believes strongly in simple index fund investing, he does allocate 20% of his investment capital to individual companies such as Apple, Amazon, and Google.

If you’re going to invest in individual companies, go with what’s familiar, he says: “Look at the products you use and consume every day; then research the fundamentals of those companies so you can learn more about their investment potential.”

It’s a strategy that investing legend Warren Buffett lives by. The billionaire only invests in companies that are within his “circle of competence,” a concept he first described in his 1996 shareholder letter.

Simply put, stick to what you know. “Defining your game — where you’re going to have an advantage — is hugely important,” Buffett says. Once you’ve done that, buy and hold.

5. Monitor your net worth:—

“I look at my net worth every day when I wake up in the morning and have my morning coffee,” Grant writes. “There are few greater motivations than seeing this number rise over time.” No matter where you start from. I’ve been keeping track of my net worth for the past five years, and my starting balance was $2.26.”

He monitors his net worth using Mint.com, which allows you to link all of your financial accounts and displays your assets and liabilities. Plus, it tracks your spending. “At the end of each year, I take a deeper dive into this data and track what I have spent the past year on everything so I can work to improve my spending,” he writes.

If bad habits are holding you back, don’t fret. Even the Millennial Millionaire is human: “In 2012 I discovered that I had spent over $3,000 on Mexican take-out food in one year, which is insane and taught me a lesson,” Grant writes.

Courtesy:— CNBC Make it